Legal Planning and Autism

All contents of this resource were created for informational purposes only and are not intended to be a substitute for professional advice, diagnosis, or treatment. Always seek the advice of your physician, therapist, or other qualified health providers with any questions or concerns you may have.

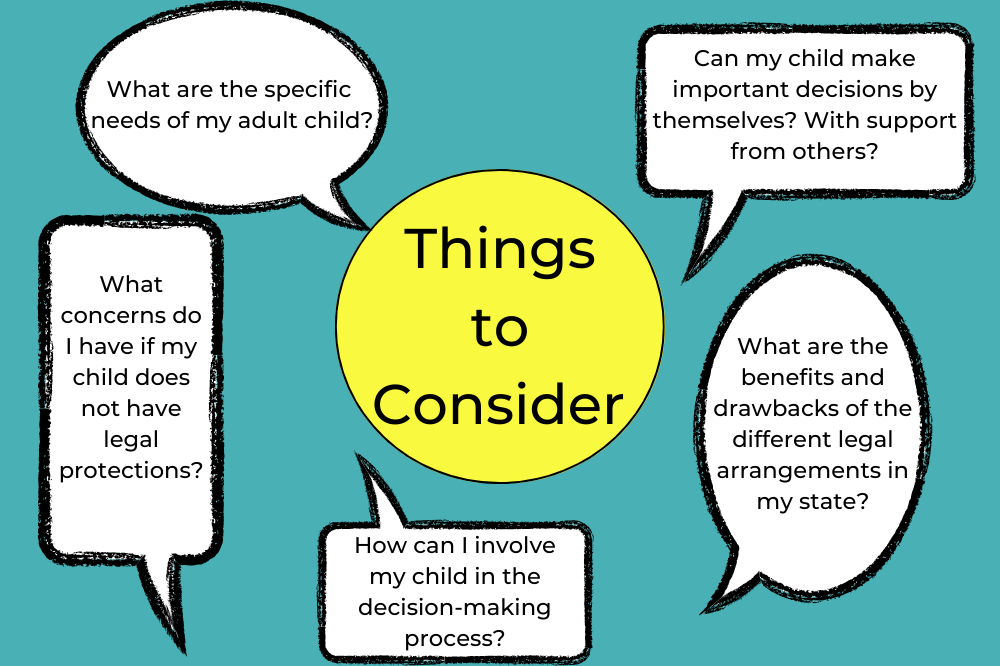

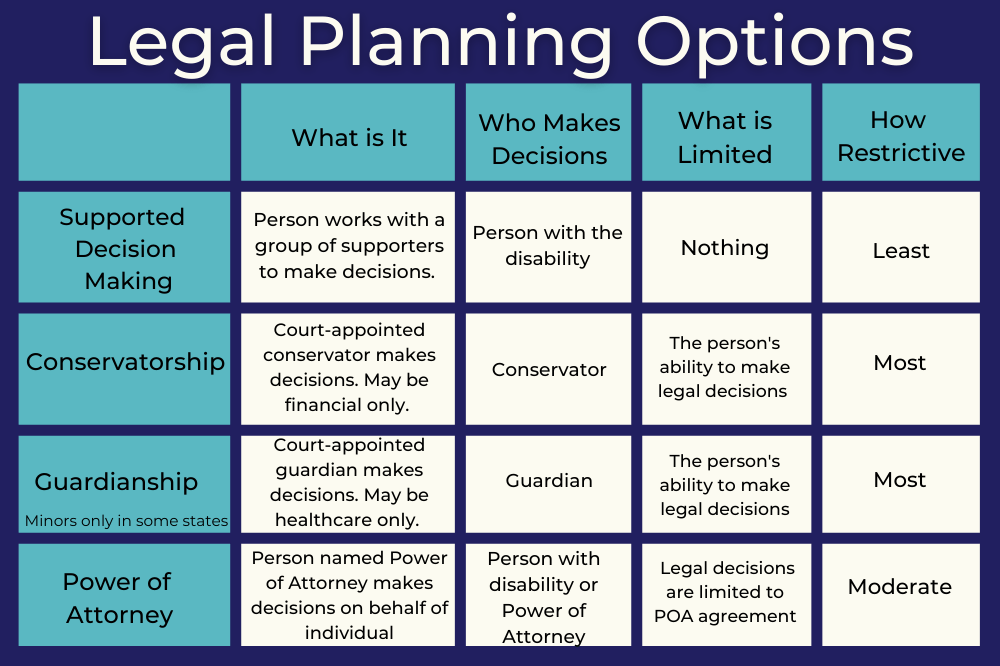

If you have a loved one with a disability that needs life-long assistance, planning for their future legal needs is essential once they become adults. There are different ways to get legal support such as supported decision-making, conservatorship, guardianship, and power of attorney. The intent is to provide legal support in the least restrictive manner possible. But remember, each state has different laws and terminology, so it’s very important to find a lawyer who knows the laws in your state.

This article covers the following:

- Supported Decision Making

- Conservatorship and Guardianship

- Power of Attorney

- When to Start the Process

- Personal Rights and Supporting Independence

Supported Decision Making (SDM)

Supported Decision Making is an alternative to conservatorship, guardianship, or power of attorney for individuals with disabilities, including autism, who need help making important decisions but do not want to give up their legal rights.

- Currently, only a few states recognize this as a legal option.

- However, many families use the principles of SDM already with their child.

- The individual needing support creates a network of trusted people to help them understand their options and make informed decisions.

- There can be as many support people as the individual wants.

- Additionally, a person can change or add supporters at any time.

- SDM can be used in a variety of situations.

- Healthcare decisions

- Financial decisions

- Living arrangements

- Social relationships

- Employment

- Most importantly, the individual can express their preferences and goals while it’s the supporters’ role to help achieve them.

- Click here to learn more about Support Decision Making from the Center for Public Representation: Supported Decision Making

Conservatorship and Guardianship

There is no standard legal definition of conservatorship and guardianship. People often use the terms interchangeably. State laws vary on what these terms legally mean. Please consult a lawyer that knows about your specific state laws.

- Oftentimes guardianship applies to a minor child under the age of 18.

- Comparatively, a conservatorship is typically for an adult 18 years old and older.

- In some states, guardianship is for medical and well-being decisions, while conservatorship is for financial decisions only.

- Both are legal arrangements where a court-appointed individual is given the authority to make financial and/or personal decisions for someone unable to make decisions themselves.

- There are different types of arrangements.

- Financial only

- Healthcare or well-being only

- General for broader decision-making authority.

- At a court hearing, a judge decides if an individual can make their own decisions or if they need a conservator or guardian.

- The court-appointed individual (conservator or guardian) may be a parent, family member, friend, or a court-appointed neutral party.

- A court is not required to make the parents a conservator at their request.

- It is up to the judge who will be the best conservator for the person with a disability.

- A conservator is responsible for acting in the best interest of the individual. They honor the individual’s right to make decisions that are not listed in the conservatorship/guardianship court order.

- Court-appointed conservators may be entitled to receive compensation for the services they provide.

- People can always change or terminate conservatorships/guardianships based on the individual’s needs.

- There are different types of arrangements.

- Petitioning the court for conservatorship or guardianship typically requires a lawyer and going to court.

- Check your state’s requirements for using a lawyer.

- Some states require two lawyers. One for the person petitioning for a conservatorship/guardianship and one for the individual with a disability.

- When a person is under conservatorship or guardianship, they cannot enter into legal contracts independently.

- This may include activities like opening credit card accounts, bank accounts, taking out a loan, buying/selling property, getting married, or signing other business contracts.

- In some states, a person under conservatorship/guardianship cannot vote.

- Most importantly, ask your lawyer very specific questions about the rights retained and limited within your state’s laws.

Power of Attorney (POA)

Power of Attorney is a legal document that allows an individual to appoint someone else to make decisions on their behalf.

- Typically, people use power of attorney for individuals who are capable of making their own decisions but require help with certain matters, such as finances or healthcare.

- There are different types of power of attorney.

- General Power of Attorney – gives the appointed person broad decision making authority.

- Limited Power of Attorney – gives the appointed person decision making authority over specific matters such as selling a property.

- Durable Power of Attorney – remains in effect even if the person becomes incapacitated.

- Springing Power of Attorney – goes into effect when a specific event or condition occurs.

- Healthcare Power of Attorney – gives the appointed person the authority to make decisions about healthcare, medical treatments, and end-of-life care.

- Financial Power of Attorney – gives the appointed person the authority to manage finances, including paying bills and handling tax returns.

- Individuals with a power of attorney may still enter into legal contracts.

- The POA allows for the appointed person to act on their behalf in matters, but the individual can still make their own decisions.

- If caregivers need access to medical records, need to speak with physicians or other healthcare professionals, or need to provide direct medical care, obtaining Power of Attorney may be helpful.

- Additionally, a caregiver with a financial POA can also pay bills, file taxes, sign legal paperwork, or lease or purchase property on behalf of the individual.

- Conservatorship and guardianship override a power of attorney.

When to Start the Process

While there is no set age to start working with an attorney, it’s important to start the process before your loved one reaches adulthood. Ideally, you want to file legal paperwork before or on the day they become adults (18 years old in most states). Contact a lawyer to begin the process at least one year before you want the legal arrangement to begin. Taking this step will help ensure that people properly address their legal needs and protect themselves in the future. Setting up legal arrangements can be a complex process, so it’s important to work with an attorney who is knowledgeable about the laws in your state.

Personal Rights and Supporting Independence

People use supported decision making, conservatorship, guardianship, and power of attorney as legal arrangements to help individuals who cannot make their own decisions or need assistance. These options are designed to be as least restrictive as possible. They do not necessarily take away a person’s rights.

- In conservatorship and guardianship, the court grants decision-making authority over specific areas, such as finances and healthcare, to the appointed person.

- However, individuals retain their rights to be treated with dignity and respect, visit family and friends, and receive appropriate medical care..

- Similarly, with a power of attorney, the appointed person has decision-making authority over specific matters, but the individual with a disability still retains their basic rights.

- It’s important to note that conservatorship, guardianship, and power of attorney are intended to be used as a last resort.

- Families should incorporate Supported Decision Making values into any arrangement to ensure that they listen to and respect the opinions, wants, and needs of individuals with disabilities.

- People can change legal arrangements based on the needs of the individual.

- Working on self-advocacy and decision-making with your child from an early age can have a lasting impact.

- Develop goals with your IEP team that focus on independence in decision-making.

Summary

In conclusion, legal planning is an important part of ensuring that your loved one with autism receives proper care and protection. People can use different legal arrangements, such as supported decision-making, conservatorship, guardianship, and power of attorney, to help individuals make important decisions. Even if supported decision-making is not legally available in your state, you can still incorporate your loved one’s opinions, wants, needs, and goals into the decision-making process. It’s important to work with an attorney who knows the laws in your state, and to start the planning process early to address your loved one’s legal needs and protect their future.